Are you tired of budgeting plans that seem impossible to stick to? You’re not alone. Many of us create monthly budgets with the best intentions, only to find ourselves overspending or feeling restricted. But with the right approach, a budget can actually feel empowering rather than limiting. It’s about finding a balance between your financial goals and your lifestyle.

In this guide, we’ll walk you through creating a monthly budget that actually works. Whether you’re just starting out or looking to refine your approach, these steps will help you take control of your finances without feeling overwhelmed.

Understand Your Income and Expenses

To start, list every source of income you receive each month. For most people, this includes salary or wages. If you have other income sources, like freelance work, side jobs, or rental income, be sure to include those too.

Once you know what’s coming in, take a close look at what’s going out. Fixed expenses are easy to track because they stay consistent—think rent, mortgage, utilities, and insurance. Next, list variable expenses like groceries, dining out, entertainment, and transportation. These costs can change month-to-month, so take an average from previous months if you need a starting point.

Quick Tip

Identify “Needs” vs. “Wants”: While going through your expenses, separate essential costs from non-essential ones. This helps in prioritizing and adjusting if you need to cut back.

Set Realistic Goals for Your Budget

Budgeting without clear goals is like driving without a destination. Ask yourself what you want to achieve financially. Maybe you want to save for a down payment on a home, reduce your debt, or set up an emergency fund.

Short-Term Goals: These might include saving for a vacation, paying off credit card debt, or building a small emergency fund. These are goals you can likely achieve within a year or so.

Long-Term Goals: These could be saving for retirement, buying a home, or creating a larger investment fund. Long-term goals require more time and commitment, so having a realistic plan in place is essential.

Quick Tip

Start Small: If budgeting feels overwhelming, start with a few achievable goals. Accomplishing smaller goals first gives you confidence and momentum to tackle bigger financial goals.

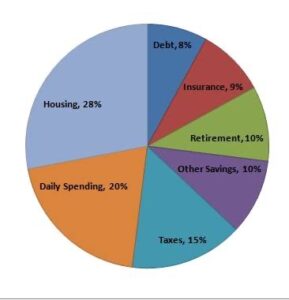

Categorize Your Expenses

Categorizing your expenses helps you visualize where your money is going. Common categories include:

•Housing: Rent, mortgage, utilities

•Food: Groceries, dining out, coffee runs

•Personal Care: Gym memberships, skincare, haircuts

•Entertainment: Streaming services, outings, hobbies

•Debt Repayment: Loans, credit card payments

• Savings and Investments: Emergency fund, retirement

By grouping expenses, it’s easier to spot areas where you’re overspending or have room to adjust.

Quick Tip

Use the 50/30/20 Rule: This budgeting rule suggests that 50% of your income goes toward essentials (needs), 30% toward wants, and 20% toward savings or debt repayment. It’s a flexible guideline to keep spending in check.

Track Your Spending

Tracking your spending is essential for staying on budget. Here’s how to make it easy:

•Use a Budgeting App: Apps like Mint, YNAB (You Need a Budget), or PocketGuard automatically categorize your spending and provide insights.

•Set a Weekly Reminder: Spend a few minutes each week reviewing what you’ve spent and compare it to your budget. This keeps you accountable without requiring a huge time investment.

The goal is not to feel restricted but to develop awareness. When you’re conscious of your spending, you’re less likely to overspend on things that don’t align with your goals.

Quick Tip

Track Small Purchases: Often, it’s the small, frequent expenses (like coffee runs or snacks) that add up. Keeping track of these “little” costs can reveal hidden areas for saving.

Automate Savings for Success

Automating your savings helps you reach your goals without effort. Most banks let you set up automatic transfers, so a portion of your income goes directly into savings on payday. This way, saving becomes second nature, and you won’t be tempted to skip it.

Try These Saving Methods:

•Percentage-Based Savings: Set aside a certain percentage (e.g., 10% of your income) each month.

•Goal-Based Savings: If you’re saving for a specific goal, break down the total amount and save toward it monthly.

Quick Tip

Use Multiple Savings Accounts: Designate different accounts for different goals (e.g., vacation, emergency fund, home purchase). This helps you stay organized and committed to each goal.

Be Flexible and Adjust as Needed

Even the best budgets need occasional adjustments. Maybe you had an unexpected expense, like a car repair, or perhaps you saved more than expected in a particular category. Being flexible with your budget allows you to adapt without giving up on your financial goals.

Monthly Review: Each month, review your spending and identify any problem areas. For instance, if you consistently overspend on dining out, you might consider allocating more funds to this category or finding ways to cut back.

Seasonal Adjustments: Sometimes, expenses fluctuate based on the season (e.g., holidays, back-to-school, or seasonal activities). Adjust your budget for these periods to stay realistic and prepared.

Quick Tip

Account for Unexpected Expenses: Life is full of surprises, so it’s wise to set aside a small “miscellaneous” budget. This can cover any unexpected expenses without disrupting the rest of your budget.

Review Your Budget Monthly

Reflecting on your budget monthly gives you valuable insight into your spending patterns and helps you make informed decisions. Did you stick to your spending limits? What worked well, and what didn’t?

Track Your Progress: Compare where you are now to where you started. Have you saved more? Paid down debt? These small victories add up, and seeing progress can be incredibly motivating.

Reward Yourself: Celebrate your wins, even if it’s something small like staying within budget for dining out. Positive reinforcement makes budgeting more enjoyable and sustainable in the long term.

Quick Tip

Plan for Next Month: Use what you learned this month to set your budget for the next. Adjust your goals and categories as needed, and keep refining your approach.

Building a Budget That Fits Your Life

Creating a monthly budget that works is about making conscious choices and being proactive with your finances. By setting realistic goals, categorizing expenses, and tracking your spending, you’re taking steps toward a more secure financial future. Remember, budgeting is a journey—celebrate small wins, learn from setbacks, and adjust as needed. Over time, you’ll see the rewards of a budget that truly fits your lifestyle.