Budgeting is a powerful tool to manage your finances, save for the future, and meet your goals. However, even with the best intentions, people often make mistakes that can throw their budget off track. In this post, we’ll go over ten common budgeting mistakes, discuss why they happen, and give practical tips to help you avoid them. Let’s dive into each mistake and learn how to create a more effective budget.

- Setting Unrealistic Goals

- Not Accounting for All Expenses

- Neglecting an Emergency Fund

- Ignoring Small Purchases

- Being Too Rigid with the Budget

- Not Adjusting Your Budget Over Time

- Underestimating Debt Repayment

- Relying Too Much on Credit Cards

- Not Reviewing Your Budget Regularly

- Failing to Budget for Financial Goals

- Building a Budget That Works for You

Setting Unrealistic Goals

Why It’s a Problem: When starting a budget, it’s easy to feel motivated and set big, ambitious goals. However, overly strict or unrealistic goals can make it challenging to stick to your budget, leading to frustration and burnout.

How to Avoid: Start with small, realistic goals that are manageable. For example, rather than cutting all discretionary spending, aim to reduce it by a certain percentage each month. Over time, you’ll find it easier to increase your goals as you build consistency.

Not Accounting for All Expenses

Why It’s a Problem: Often, people forget about irregular expenses like annual subscriptions, car repairs, or holiday gifts. These “surprise” expenses can disrupt your budget and lead to unnecessary debt.

How to Avoid: List out all of your regular and irregular expenses. Consider adding a “miscellaneous” category to cover unexpected costs. Another option is to track last year’s occasional expenses to identify trends.

Neglecting an Emergency Fund

Why It’s a Problem: Without an emergency fund, unexpected costs like medical bills or urgent home repairs can derail your budget, forcing you to rely on credit.

How to Avoid: Prioritize building an emergency fund by setting aside a small amount each month. Aim to save up at least three to six months’ worth of expenses for security and peace of mind.

Ignoring Small Purchases

Why It’s a Problem: Small expenses like daily coffees or impulse buys may seem harmless, but they add up over time, affecting your budget without you even realizing it.

How to Avoid: Track every purchase, no matter how minor, for a month. By doing this, you’ll understand where your money is going and can make adjustments to reduce unnecessary spending.

Being Too Rigid with the Budget

Why It’s a Problem: While it’s important to follow a budget, being too restrictive can make it feel like a burden, increasing the risk of “budget burnout.”

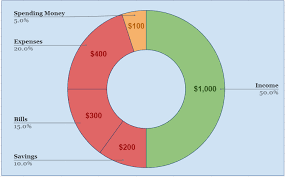

How to Avoid: Add a “fun money” category in your budget to allow for a little flexibility. Knowing that you have funds for occasional treats makes it easier to stick to the budget long term.

Not Adjusting Your Budget Over Time

Why It’s a Problem: Life changes, and so do your income and expenses. Not revisiting your budget periodically can make it outdated, leading to inaccurate planning.

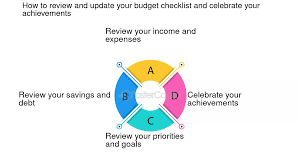

How to Avoid: Schedule a time each month or quarter to review and adjust your budget based on any changes in income, expenses, or financial goals.

Underestimating Debt Repayment

Why It’s a Problem: Failing to account for debt payments in your budget can slow your financial progress, as unpaid debt accumulates interest, becoming harder to pay off over time.

How to Avoid: Include debt payments as a priority line item in your budget. Try using the “avalanche” or “snowball” method to focus on high-interest debt first for faster payoff.

Relying Too Much on Credit Cards

Why It’s a Problem: Credit cards can be convenient but also tempting, often leading to overspending and accruing debt that grows over time due to high interest.

How to Avoid: Limit credit card use and, if possible, switch to a cash or debit card system. Commit to only using credit for planned purchases and aim to pay the balance in full each month.

Not Reviewing Your Budget Regularly

Why It’s a Problem: Not reviewing your budget leads to a disconnect between your current financial reality and your budget, making it easy to fall behind on goals.

How to Avoid: Set aside a regular time to review your budget each month. Look for any overspending, analyze where you stayed on track, and adjust for the upcoming month.

Failing to Budget for Financial Goals

Why It’s a Problem: Overlooking long-term savings goals (like a house, retirement, or education fund) can make it difficult to make meaningful progress toward those goals.

How to Avoid: Identify specific financial goals and include them in your monthly budget. Start with small contributions and increase them gradually. Remember, every little bit adds up.

Building a Budget That Works for You

Budgeting isn’t a one-size-fits-all process. It’s about building a plan that aligns with your lifestyle, goals, and circumstances. By being aware of these common budgeting mistakes and taking steps to avoid them, you’ll create a budget that’s not only sustainable but also helps you achieve your financial dreams.

By implementing these strategies and reviewing your budget regularly, you’ll build healthier money habits and stay on track toward your financial goals. Happy budgeting!